Our experts frequently write blog posts about the findings of the research we are conducting.

Could Credit Rating Agencies be Held Accountable This Time?

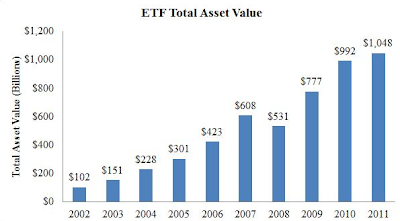

ETFs' Asset Value is Increasing, Trading Volume Remains Stable

Dealbreaker on the Hayes award and LCM VII CLO

A Wipeout That Didn't Have to Happen

Schwab Sues FINRA RE: Class Action and Consolidated Claims

FINRA's complaint charges that in October 2011, Schwab amended its customer account agreement to include a provision requiring customers to waive their rights...

SLCG Research: Reverse Convertibles and Stochastic Volatility

Freddie Mac, complex derivatives, and one huge conflict of interest

President and CIO of Direxion admits that leveraged ETFs are not appropriate for most investors

The leveraged indexed ETFs are used by very tactical investors, and so there we have bull and bear funds. They have daily betas, which means that essentially...

Interest Rate Swaps

FINRA Regulatory Notice: Complex Products